National Pension System

What is National Pension System?

A government sponsored retirement savings scheme

Regulated by Pension Fund Regulatory and Development Authority (PFRDA)

Allows regular contribution to a pension fund during working life

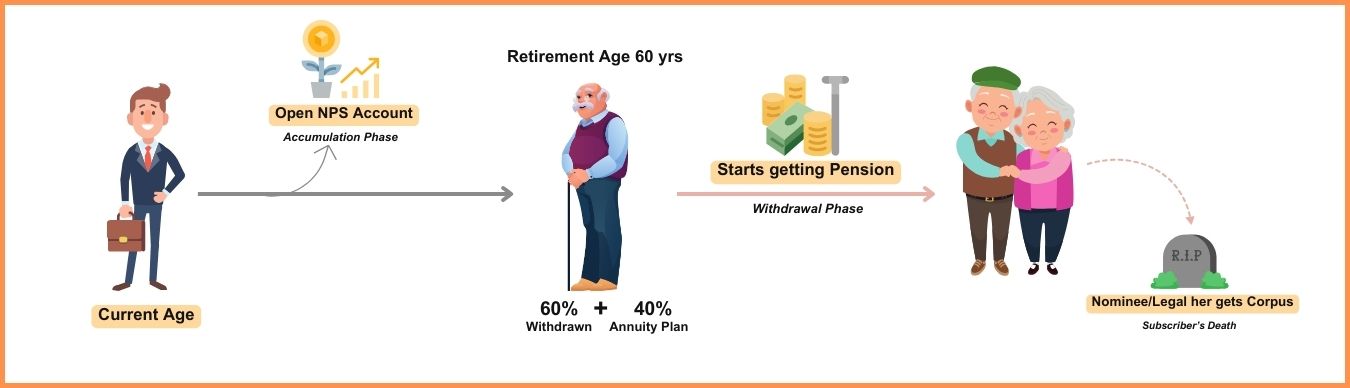

On retirement, a part of the corpus can be withdrawn in lump sum

Subscribers choose from Equity and Fixed Income funds to grow savings

Balance corpus is invested in an annuity plan to secure regular income

How it works?

Key Features

Saving for retirement can be a daunting task, but it doesn’t have to be. With a managed NPS account, you can build a portfolio to grow your savings to fund the retirement you have always dreamt of.

Eligibility

Every Indian citizen (including NRIs) who is between 18-65 years is eligible to invest in NPS. However, the person should not be undischarged insolvent or of unsound mind.

To apply for the NPS, he subscribers should comply with the Know Your Customer (KYC) norms as detailed in the subscriber registration form.

Tax benefits

Tax benefit under IT Section 80C up to Rs 1.5 lacs and additional benefit of Rs 50,000 for tax deduction under Section 80CCD.

Under Corporate NPS, the employer can deduct 10% of employee’s salary as business expense and the same amount is allowed for deduction for the employee with no upper limit

Account types

Tier I - Pension account (mandatory account) with tax benefits and restricted withdrawals.

Tier II - Investment account (optional account) with no tax benefit but corpus is withdrawable anytime.

Investment options

Auto Choice: Investment in equity, corporate debt and government securities is made in pre-defined proportion depending on the investor’s age.

Active Choice: Investors have the freedom to design their portfolio allocation between equity, corporate debt and government securities and alternative assets (like Real Estate Investment Trusts) tailored to their needs

Investment

Start with a minimum investment of as low as Rs 500 for Tier I plan and Rs 1,000 for Tier II. Even the yearly contribution is very low - Rs 1,000 (minimum amount per contribution Rs 500) for Tier I plan and no compulsory yearly contribution. in Tier II. However, the minimum investment per contribution is Rs 250 in later.

Withdrawals

At maturity age of 60yrs, subscriber can withdraw 60% of the corpus from Tier 1 tax-free, while 40% to be reinvested in a life annuity product for getting regular pension. Amount reinvested in purchase of annuity, is fully exempt from tax. However, subsequent annuity income will be subject to tax as per your applicable income tax slab.

Investor in Tier II plan can withdraw money anytime, but it will be taxable.